Texas car title loans offer swift cash access for individuals with limited credit options, flexible repayment terms, and potential lower interest rates compared to other short-term lending options. Secured by the vehicle's value, these loans cater to those ineligible for traditional credit checks. Repayment involves clear terms, timely payments, and open communication to avoid fees and maintain financial stability.

“Texas car title loans offer a unique financial solution for borrowers in need of quick cash. This article guides you through the essentials, ensuring you make informed decisions. We explore the basics and benefits of these loans, clarify eligibility criteria, and outline a safe repayment process. By understanding Texas car title loans, borrowers can access much-needed funds while maintaining control over their vehicle. Discover how this option can be a practical choice for your short-term financial needs.”

- Understanding Texas Car Title Loans: Basics and Benefits

- Eligibility Criteria: Who Qualifies for These Loans?

- Repayment Process: How to Pay Back Your Loan Safely

Understanding Texas Car Title Loans: Basics and Benefits

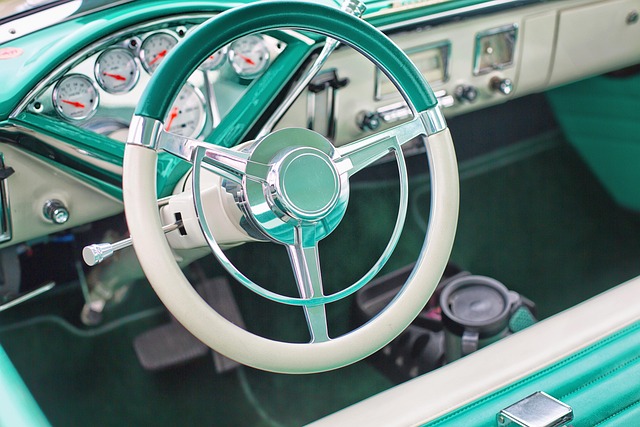

Texas car title loans are a type of secured financing where borrowers use their vehicle’s title as collateral. This loan option is popular among those in need of quick cash, offering several advantages. One of the key benefits is accessibility; with fewer requirements compared to traditional loans, individuals with poor credit or no credit history can still apply. The process involves providing the car’s title and a government-issued ID, ensuring a swift approval time.

Additionally, Texas car title loans have flexible repayment options tailored to borrowers’ needs. Loan terms typically range from 30 days to several months, allowing individuals to repay the loan at their own pace. This flexibility, coupled with potential lower interest rates than other short-term lending options, makes these loans an attractive solution for immediate financial needs.

Eligibility Criteria: Who Qualifies for These Loans?

In Texas, car title loans are a popular option for borrowers seeking quick cash. To qualify, applicants must own their vehicle outright, with no outstanding loans on it. This includes cars, trucks, SUVs, and even motorhomes—basically, any motor vehicle that can be titled in the borrower’s name. The lender will then place a lien against the vehicle as security for the loan, making it a secured loan type.

While these loans are accessible to many, they’re particularly beneficial for individuals with limited credit options due to poor credit scores or no credit history. Unlike traditional bank loans that heavily rely on credit checks, Texas car title loans assess the value of your vehicle and its potential as collateral. This makes them a viable option for borrowers with histories of bankruptcy, late payments, or even those deemed ineligible for Bad Credit Loans or Semi Truck Loans.

Repayment Process: How to Pay Back Your Loan Safely

Repaying a Texas car title loan is designed to be a straightforward process, allowing borrowers to focus on getting back on solid financial footing. The key to a safe repayment lies in understanding your obligations and sticking to a consistent plan. Once approved for a loan, lenders will provide clear terms outlining the amount due, interest rates, and repayment schedule. Borrowers can expect regular communication from their lender regarding payment due dates.

To ensure a smooth loan payoff, borrowers should prioritize timely payments. Missing or delaying payments may incur additional fees and negatively impact credit scores. Most importantly, if you encounter financial difficulties, reach out to your lender as soon as possible. Many lenders are willing to work with borrowers to adjust repayment terms, ensuring they can get back on track without defaulting on their loan. Remember, transparency and communication are essential when it comes to managing Texas car title loans.

Texas car title loans offer a quick solution for borrowers in need of cash, but it’s crucial to understand the process and repayment terms before securing one. By understanding the basics, eligibility requirements, and safe repayment practices, individuals can make informed decisions when considering these loans. Always remember that while they provide benefits, proper financial management and careful consideration are essential to avoid potential risks associated with any loan type.